Technology is empowering consumers with unprecedented powers to set the rules of engagement when buying goods and services. To survive and thrive, businesses must embrace innovative, customer-centric strategies and data-driven approaches designed to improve the user experience.

In health insurance, these trends are becoming increasingly critical. Insurers are relying on digital and data to drive loyalty and growth. They are also looking to provide a more personalized service, connecting the customer touchpoint dots to map out cohesive, end-to-end journeys.

Digital health platforms offer insurers new ways to connect and engage with their audiences. But what are the key requirements for these digital hubs to deliver on the exciting potential of digital?

- Open by design

A digital health platform must be open to third-party integration, so systems can easily connect with those of an insurer’s ecosystem partners (e.g. providers), encouraging and enabling cross-system data-sharing.

If insurers can analyse real-time data, they will have the information required to offer services that meet their customers’ needs, taking into consideration the full customer lifecycle. They are no longer limited by their own sources of information.

Moreover, digital health platforms that support IoT and API integration make it easier to add new modules without having to develop them from scratch. Insurers looking for innovative ways to meet customer satisfaction are looking at IoT integration as a solution to lower costs, improve control and raise the level of quality in healthcare.

- User-friendly by design

Digital health platforms should be built to adapt and evolve around insurers’ strategies, offering self-service and personalized services. User-friendliness is key to customer adoption and, ultimately, success.

For instance, teleconsultations represent a great way to support insureds where and when they need it. Simple and secure, they save patients and care providers alike time, ultimately improving customer satisfaction.

Today’s consumers expect to manage services at the touch of a button, and for those services to be delivered in a rapid, personalised manner. By integrating healthcare records and teleconsultation systems on a single digital, interoperable platform, insurers are ideally placed to meet these expectations.

- Analytics Dashboard

When accessing large volumes of data, insurers need the capability to analyze and make sense of it all. By converting data into information, such tools drive better decision-making. Insurers can leverage data to target high-cost demographic areas or physician groups and focus on improving health to drive down costs.

Is a patient not meeting their fitness goals? Are they displaying high levels of distress? Insurers can leverage customer behaviour analytics to study their habits and identify areas of behaviour or susceptibility to health issues to address.

- Conversational Interfaces

Traditional, reactive services like GP visits, emergency room care and prescription coverage are no longer sufficient. Customers are looking for support in prevention, not just cure. That’s why they’re embracing “Wellness Programs”, which are tailored to help avoid non-chronic diseases.

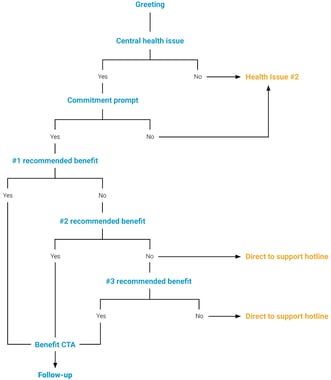

In order to succeed, insurers need to make customers aware of these programs, help them choose the most relevant to their needs and guide them towards rewards. Conversational interfaces can facilitate success through predetermined responses that provide patients with feedback or point them towards relevant products and services.

By seamlessly linking into conversational apps, a digital health platform can improve customer engagement. Such apps don’t require heavily designed components, and can easily be driven by a bot (SMS, Facebook Messenger, chatbots).

*Example of a conversational workflow.

- State of the art capabilities

The fewer tasks insurance agents have to undertake, the more time they have to foster relationships with potential customers, which also translates into quicker and more efficient ways to onboard customers. Through digital solutions such as electronic signatures and payments, insurers and providers can achieve significant time and efficiency gains.

Electronic signature platforms integrate seamlessly into existing business processes and systems. They help streamline workflows and reduce costs, always meeting compliance requirements.

Another benefit of digital health platforms is their ease of integration with geolocation systems. These are great tools to match insurance plans and the services they offer with customers’ individual profiles.

Key Takeaways

● Insurers must adopt a customer-centric, data-driven approach to healthcare, embracing digital solutions and integrating these with existing systems.● A digital health platform must allow insurers to easily connect to other systems, facilitating Big Data collection and the delivery of personalised services.

● Digital health platforms need to integrate seamlessly to other systems, enable personalization, facilitate analytics and integrate conversational interfaces, thereby helping insurers gain productivity by connecting to e-signature and geolocation platforms.

If you are interested in this topic, the Cegedim Insurance Solutions team is at your disposal to answer to all your questions.